We had a record setting, knock the barn doors down year last year

By joe

- 5 minutes read - 1021 words… and believe it or not, I forgot to mention it. This is the first time in company history that we had a backlog going into Q1. Orders being built and tested on the last work day of the year. We grew, not the amount we had originally forecast, but we understand why (and sadly have little control over that aspect). We are working very hard on our appliances … I am blown away as to how perfect a fit they are for folks. I have to say I am floored by folks like Nutanix, Pure Storage, Nimble, etc. getting billion dollar valuations. For a long time I’ve been saying to friends and investors that this is a bubble, and its ready to pop. Only I am wrong about the ready to pop part. I could be wrong about the bubble part. In which case … well … We just signed up an awesome reseller partner in India, these guys are fantastic, and are taking us places. We are behind in developing things for their needs, I am hoping to get caught up soon. We are looking to sign another in Europe, with some former colleagues from the distant past. Again, we like the very high quality, hard driving, solution focused folks, whom really value the “V” portion of value added reseller. We’ve just brought on a new techie to help with the build volume, and have 2 new sales agents pushing hard for us. Our Scalable OS is taking good shape (the OS base distro has been almost finalized), and the RESTful API is almost complete. I am working on the object storage part, tring to solve a thorny problem in an open and not platform dependent manner, and I’ve had a cool insight I need to code up and try. The GUI portion is also nearing completion. It is a client of the RESTful API as much as the CLI is, so once the RESTful API is feature/functionally complete the CLI and GUI will be very close to complete as well. Our hardware sets records others can’t touch … not by 10 or 20%, but much more. Our partners benefit from our performance as it really highlights their capabilities … though sometimes this gets lost in the telling of the story. Our thesis has always been, and continues to be, great software needs awesomely fast hardware to run on, or its not going to shine. This is part of why we’ve been creating our appliances. Build something insanely fast as a basis, and have the software just scream on it. Higher performance and higher density almost always lowers customers acquisition and total lifetime costs. You can do more, and spend less. Use less power, space, cooling. Less administrative resource. Performance is an enabling technology. Remember this. Overall, things are going quite well, though we have all the trappings and roller coaster emotions of a startup. We are a startup … 11+ years old, and bootstrapped, but we are still a startup. We’ve been pushing hard all this time, and we’ve had ups and downs over the last 11+ years. We’ve had a few feelers from others interested in acquisition in the last year, but we’ve not seen anything that even merits a serious response (seriously, coming to us with a “give us your company and we may pay you in the future” is not a reasonable opening or closing offer … sheesh!) . And this is where our nice anti-bricking technology comes into play. If a bus hits us, or we get bought out to go make potato chips, our kit is supportable by paying someone else to do this. See if you can do that when (insert random competitive vendor with closed technologies) get bought/go under/… I was reminded of this, by this post, where the author talked about how close startups are to the abyss. Remember in the past where I talked about the abyss, and during some of the harder months in the past, you stared into it, and felt the gaze being returned? Yeah, running a company is terrifying like that. You can have the best idea in the world, and go bust. You can have a stellar team, and still crater. You need the right combination of idea, execution, team, luck, money, market, timing, fit, product … And its easy to mess any of these up. We are bootstrapped, so while we have most of these, money from investment is not something we have. Which means that we have to live within operationally funded budgets … we have to make money … every month … or else. Do that for 11+ years. See how much hair you have left, or if any of it isn’t grey. The paragraph that resonated with me was this one

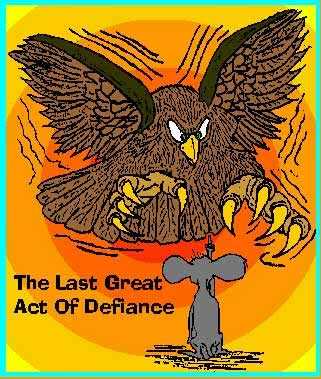

Everything can and does go wrong. Usually at the worst possible moment. Its how you respond to those challenges, the character you exhibit in the face of imminent doom, the “damn the torpedoes, full steam ahead” approach … this is what defines you.

This mouse is the entrepreneur, and the eagle represents everything coming out to destroy them … the market, competitors, customer deals gone horribly bad, “partners” whom are really trying to burn you. I love what I do. I love working with customers. I love having the fastest hardware on the planet. I love having the best partners. I wish we had enough revenue so we didn’t need to go to VCs and raise money, but, as I said, our growth projections were off, rate limited by our personal bandwidth limits. But I am at the same time blown away that companies nominally competitive with us (in different sections of the market, late comers at that, formed well after we started in this area) are raising $100M+ on billon dollar valuations. This is a terribly exciting time to be building integrated storage and computing offerings, SAN in a box, or whatever you want to call them. 2014 should be an even wilder ride … it was shaping up to be by the second day of the year.